- Email:

[email protected]

Phone:

+918010117117

StoreHippo Help Center

StoreHippo Help Center

- Home

- Store Settings

- Tax rules

Tax rules

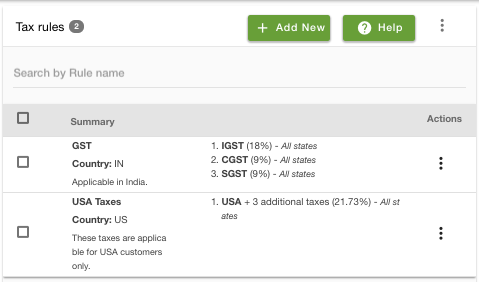

Mr.Rajiv kumarCalculating the tax for your online store is essential if you plan to sell taxable items. StoreHippo allows you to set up a number of tax rules that you might need to charge on your sales varying with different countries and states.

You can manage the tax rules in the Settings > Tax Rules section of StoreHippo Admin Panel.

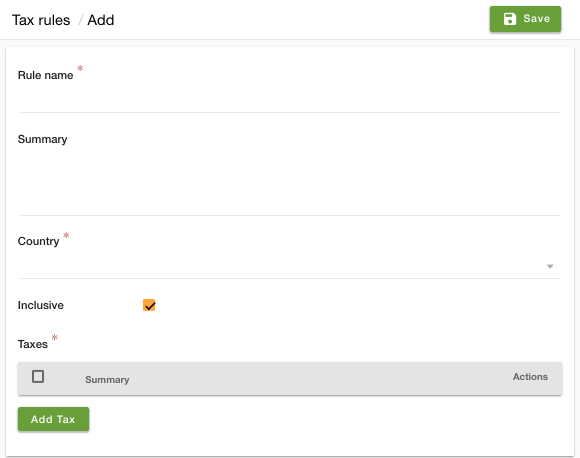

Adding a Tax Rule

To add a new tax rule, click on the Add New button in the top right corner. Clicking on the button will open a form with

Rule name

Enter the name of the tax rule.

Summary

Enter a summary of the tax rule.

Country

Select a country for which you want to define the tax rule.

Inclusive

By default, all the taxable amounts are configured to be inclusive of taxes. If you wish to make the taxable amounts exclusive of this tax, uncheck this field.

Taxes

You need to define all your taxes of the tax rule under this field. Clicking on 'Add Tax' will open a form with

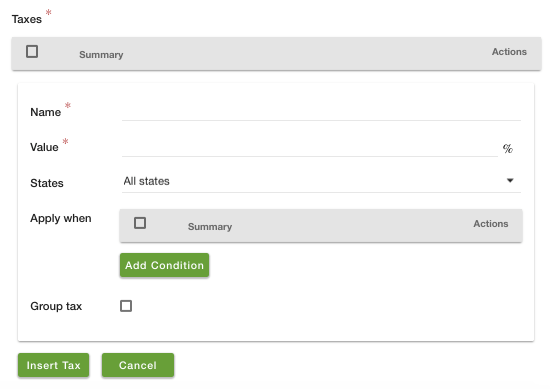

Name

Enter the name of the tax.

Value

Enter the value of the tax rate.

States

You can define the states in which the tax is applicable in this field. You can define the tax to be applicable either in all states or specific states only or even excluding some specific states.

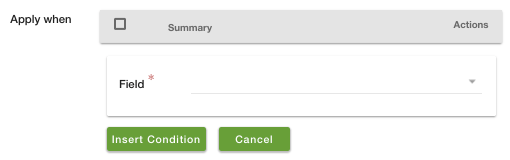

Apply when

As per GST rules, different variants of the same product can have a different tax rate. To support that requirement, there is an extra condition to specify the price of the product. So you can define different tax rates based on the price of the product. For example, a product if sold below X amount might have a different tax than if the same product or its variant is sold for an amount above X.

Also, there is a support to specify conditions for HSN/SAC codes. That allows you to reuse the same tax rules for multiple products or have a common global rule that applies to your entire

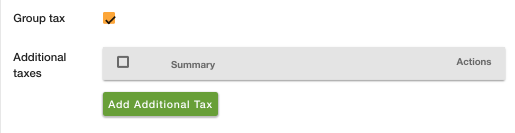

Group tax

If the tax contains additional taxes, you need to check this field. A group tax is defined as a tax which constitutes additional taxes. For example, the Service Tax of India is 14% which is a group tax, comprises an additional 0.5% of Krishi Kalyan Cess and 0.5% of Swachh Bharat Cess, thus making the effective total rate as 15%.

Additional taxes

To define an additional tax, you need to click on 'Add Additional Tax' which will open a form with

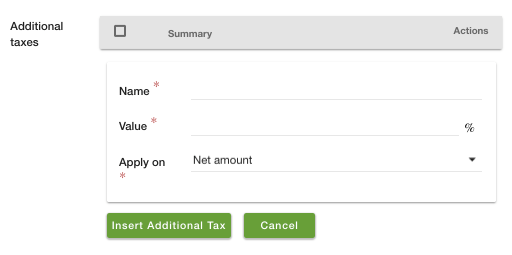

To define an additional tax, you need to define the following fields:

Name: The name of the additional tax.- Value: Rate of the additional tax.

- Apply on: In most of the cases, the additional taxes are applied to the net amount. However, if your additional tax needs to be applied on tax amount you can set the Apply on as Tax amount.