Helpcenter +918010117117 https://help.storehippo.com/s/573db3149f0d58741f0cc63b/6969f0c18a8568e4561210d8/storehippo-logo-500-1--480x480.png" [email protected] https://www.facebook.com/StoreHippohttps://twitter.com/StoreHippohttps://www.linkedin.com/company/hippoinnovations/https://plus.google.com/+Storehippo/posts

B4,309-10 Spaze iTech Park, Sector 49, Sohna Road, 122001 Gurgaon India

Create a Trial Store StoreHippo.com Contact Us

- Email:

[email protected]

Phone:

+918010117117

StoreHippo Help Center

StoreHippo Help Center

call to replace anchor tags contains '/admin' in href2018-09-10T06:36:33.267Z 2021-02-02T11:15:05.404Z

How to add different taxes for separate sellers?

Mr.Rajiv kumarScenario

You want to add different taxes for separate sellers.

Steps

StoreHippo allows you to set up a number of taxes for different countries, states, and conditions, etc. You can also define different taxes for separate sellers. Follow the below steps to set up taxes for a seller:

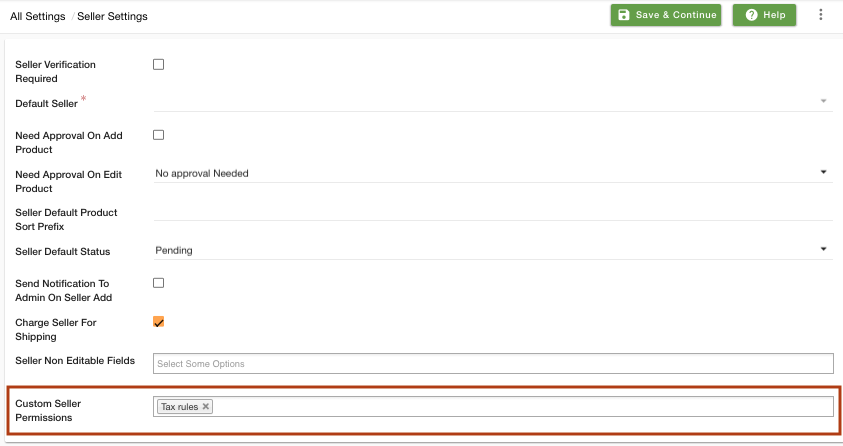

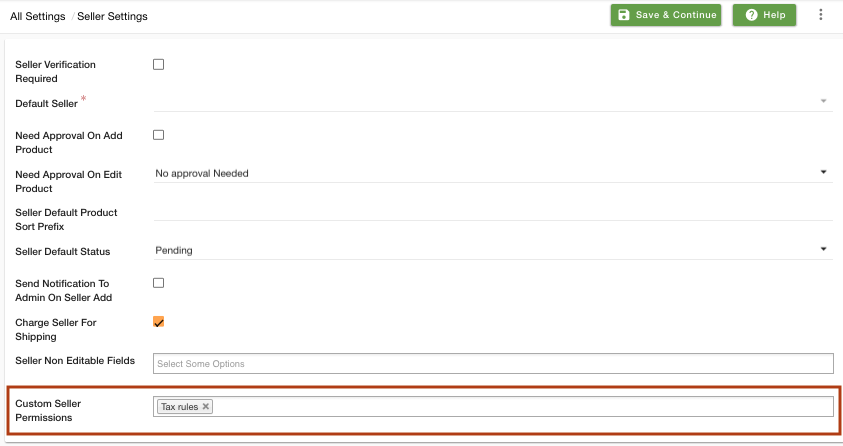

- Go to Settings > Seller Settings section in StoreHippo Admin Panel.

- Find the Custom Seller Permissions field. Select "Tax rules" from the drop-down.

- Save the changes.

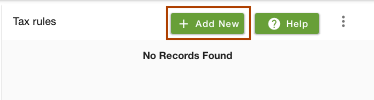

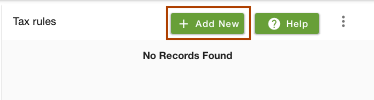

- Go to Settings > Tax rules section in StoreHippo Admin Panel.

- Click on Add New to add a new tax.

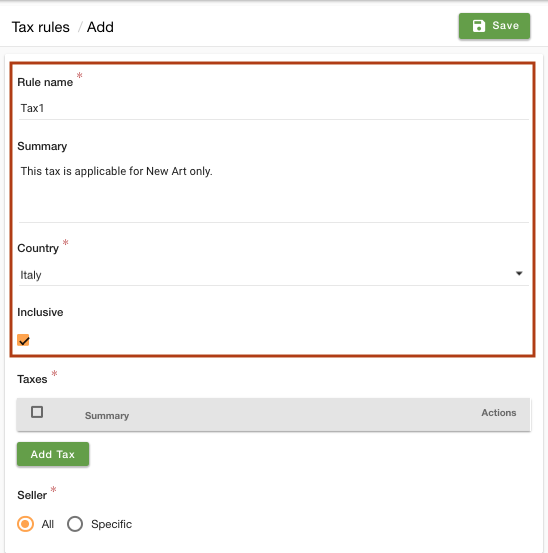

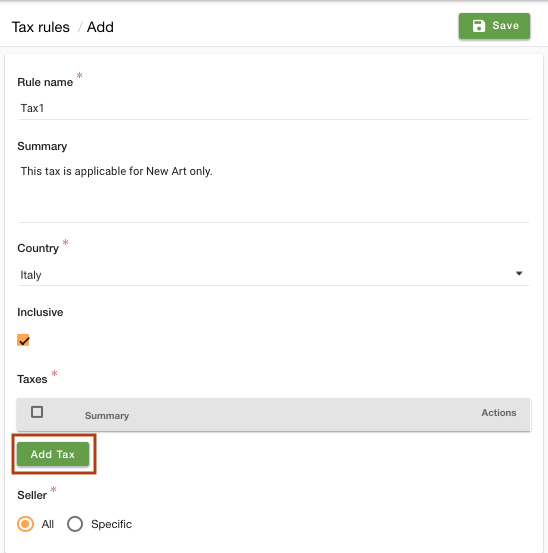

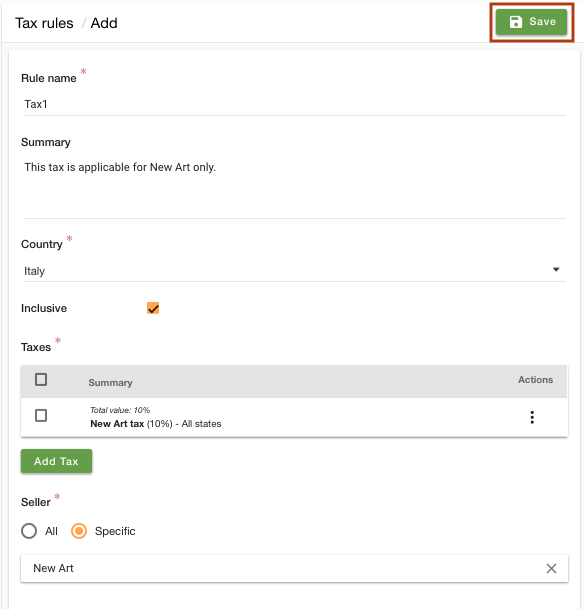

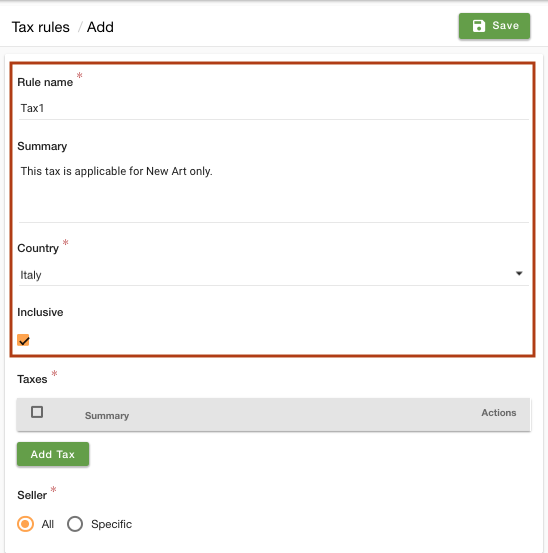

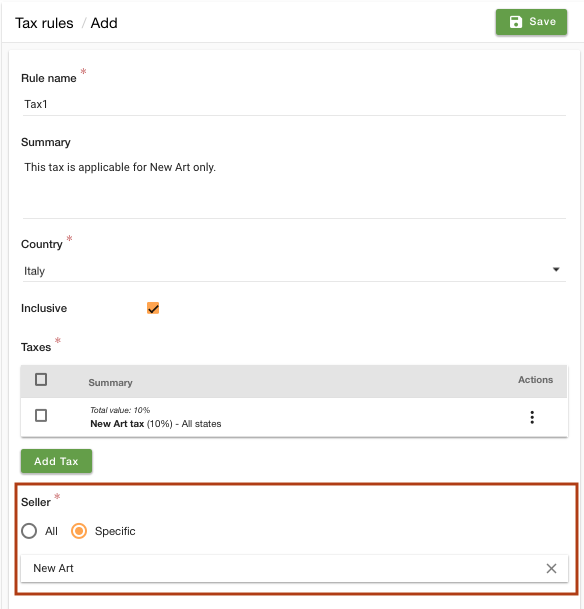

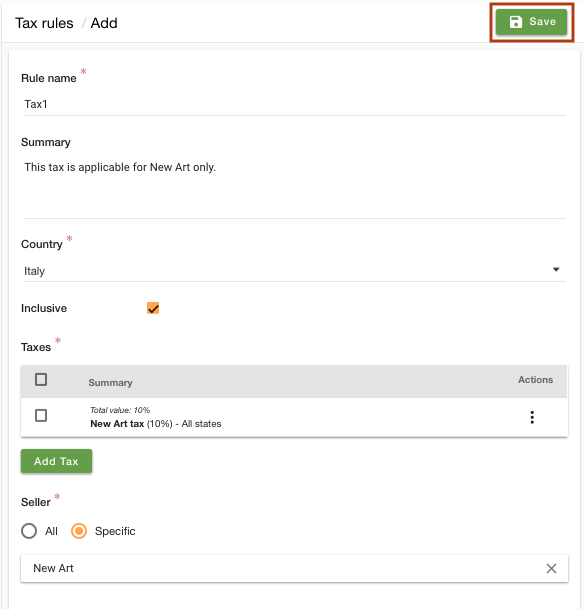

- Provide the Rule name as "Tax1". Enter the summary of the tax if you wish.

- Choose the Country as "Italy".

- Uncheck the Inclusive field, if you wish to make the taxable amounts exclusive of this tax.

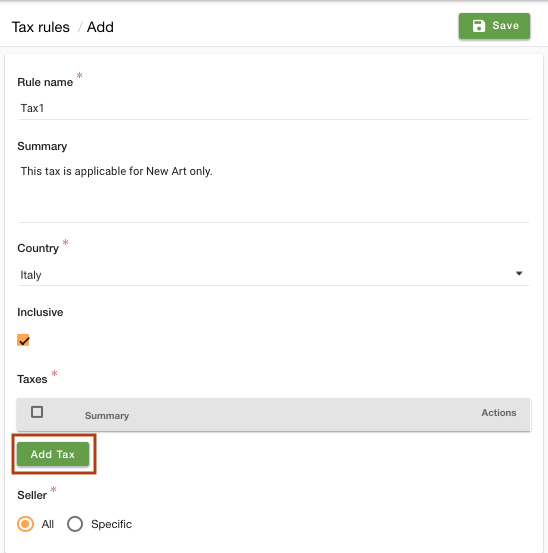

- Click on the Add Tax to define the taxes.

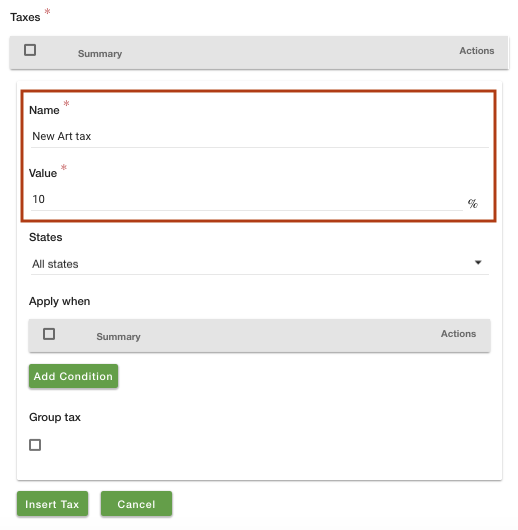

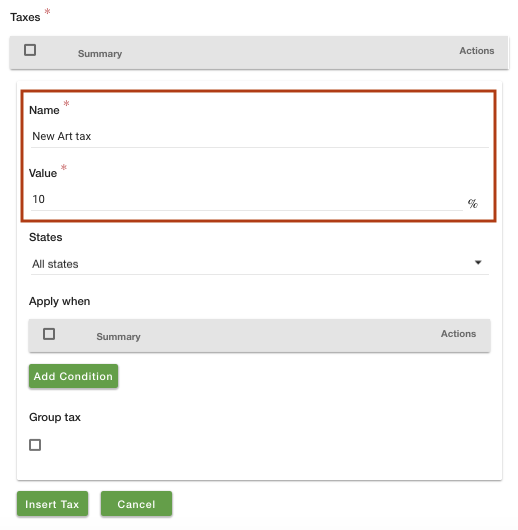

- Enter the Name as "New Art tax" and Value as "10" of the tax.

- You can choose all states or any specific state for which you want to apply the tax. You can apply the condition and group tax if you wish.

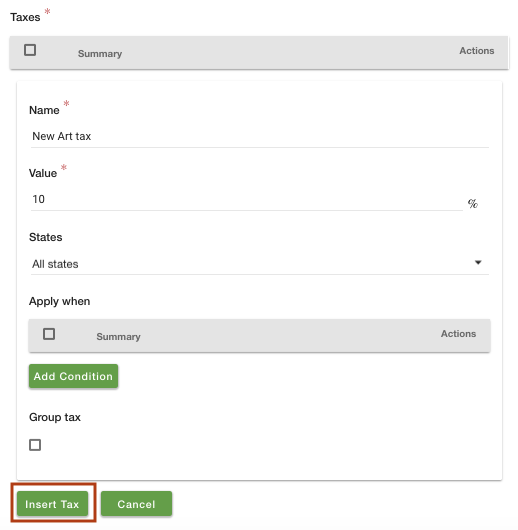

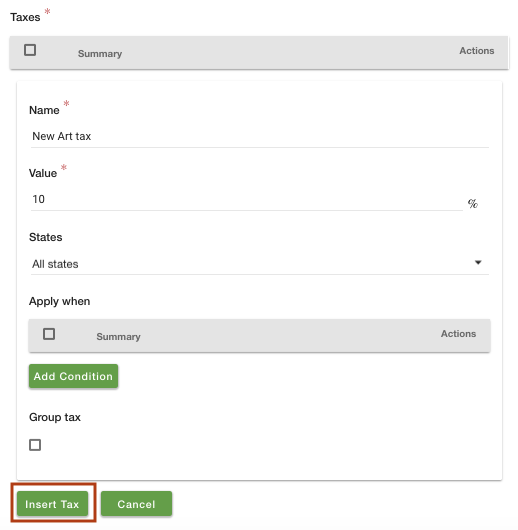

- Click on Insert tax button.

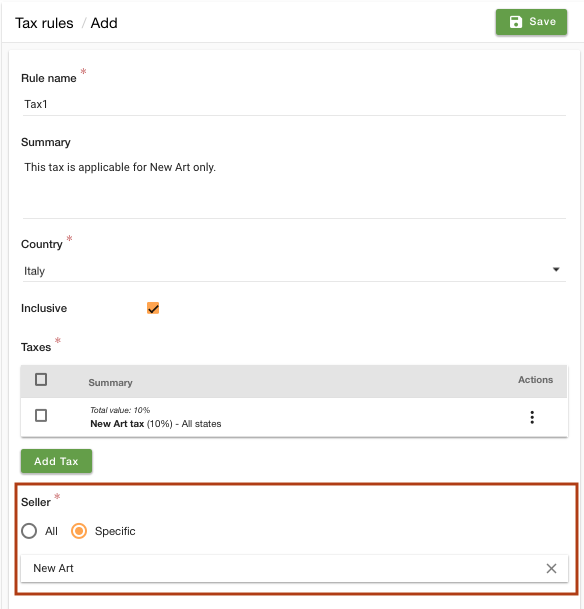

- Now in the Seller field, choose to add taxes for the "specific" seller. Choose the seller from the drop-down.

- Click on the Save button to add the tax.

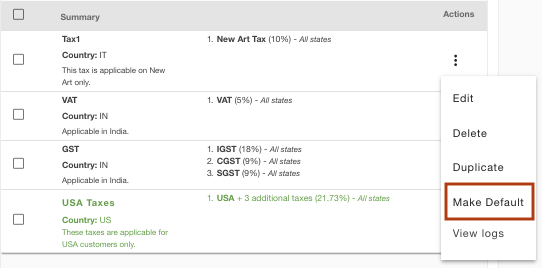

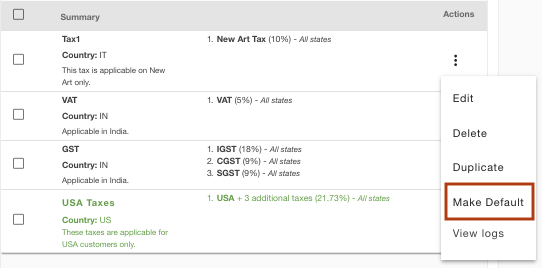

- Now click on the ellipsis button and

choose Make default option from the drop-down to apply the tax by default on all the products of the store.