- Email:

[email protected]

Phone:

+918010117117

StoreHippo Help Center

StoreHippo Help Center

- Home

- Miscellaneous Settings

- Tax deducted at source (TDS)

Tax deducted at source (TDS)

Mr.Rajiv kumarStoreHippo lets you apply TDS (Tax Deducted At Source) which is a direct taxation mechanism introduced to collect taxes from the source of income itself or at the time of income payout.

As per this concept, a person (deductor) who is liable to make payment of specified nature to any other person (deductee) shall deduct tax at source, remit the same into the government account, and transfer the balance to the deducted. The person who makes the payment deducts tax at the source, while the person who receives a payment/income has the liability to pay tax.

TDS Calculation

Calculation of the TDS tax is explained with the help of an example below where the shipping charges are applied and tax is inclusive: Order Value: 1400/-

Order Value: 1400/-

Shipping Value: 100/-

Total Order Value: 1500/-

GST on the order value at the rate of 5% for value 1400/- is: 66.67/-

GST on Shipping of value 100/- at

Total Order Amount (A): 1500/-

Total GST Amount (B): 71.43/-

Net Amount (C)=( A-B): 1428.57/-

TDS of 5% Should get deducted on the of 1428.57/- which will be 71.4/-  It gets deducted from the seller Payments in the seller commission Invoice.

It gets deducted from the seller Payments in the seller commission Invoice.

Enabling TDS

By default, the TDS is not enabled in your store. To enable the TDS, follow the steps mentioned below:

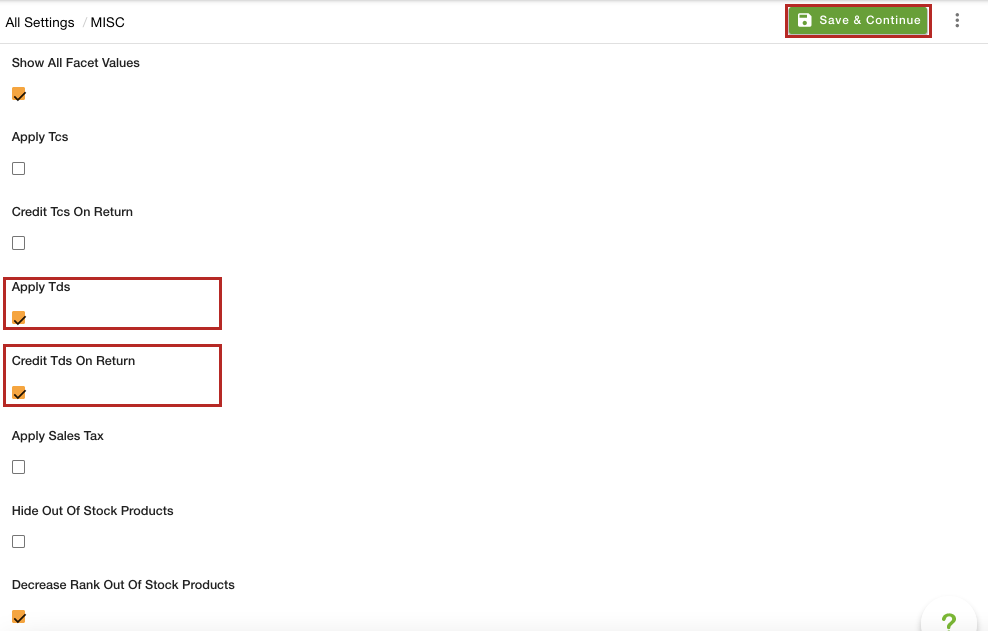

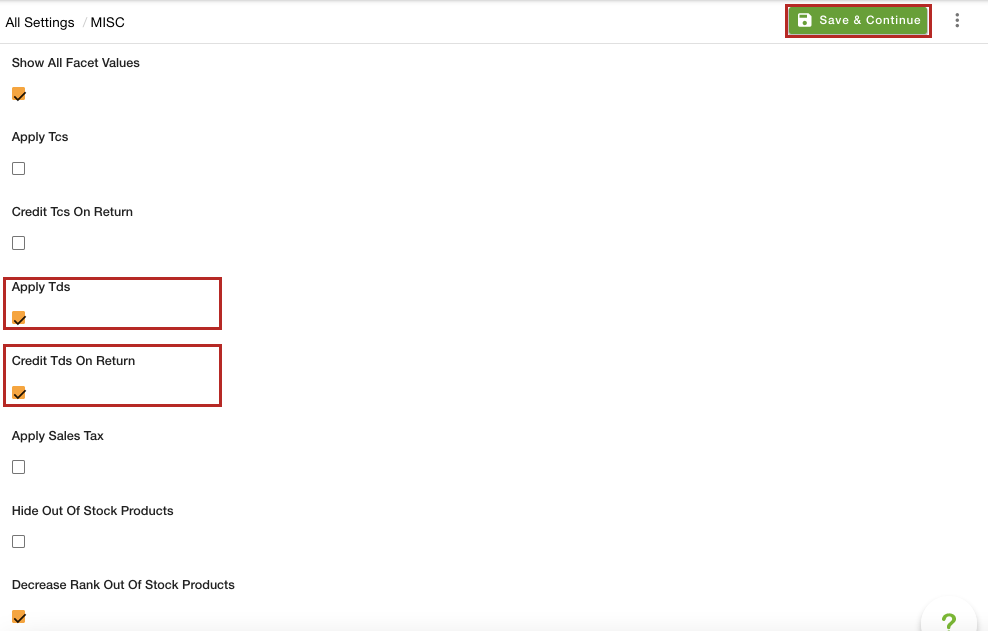

- Go to the Settings > Miscellaneous section in the StoreHippo Admin Panel.

- Search for the Apply Tds checkbox and select it.

- Enable the Credit Tds On Return checkbox. This will credit the deducted TDS to the customer's account in case of the order return.

- Click the Save & Continue button to apply the changes.

Now, the TDS will be applicable for both purchase orders and return orders.

Seller Ledger

Whenever a seller transaction occurs in the store, the entry is added in the Seller Ledger section. Therefore, when the TDS tax is deducted, the debit entry of 5% of the total amount of the order value is added to the seller ledger.

Whenever a seller transaction occurs in the store, the entry is added in the Seller Ledger section. Therefore, when the TDS tax is deducted, the debit entry of 5% of the total amount of the order value is added to the seller ledger.

- If the e-commerce participant has provided the PAN, TDS will be deducted at the rate of 1% on Gross Sales.

- If the deductee does not provide the PAN or Aadhaar, then TDS shall be deducted at the rate of 5% irrespective of the gross sales amount.

- You can add the seller PAN details, after selecting "India" as the country. Click here, to know more about adding the seller.