- Email:

[email protected]

Phone:

+918010117117

StoreHippo Help Center

StoreHippo Help Center

Seller ledger

Mr.Rajiv kumarIn a multi-seller marketplace, admin and sellers need to keep a track of different transactions that take place in their accounts. It allows you to view and manage these transactions.

Go to the Sellers > Seller Ledger section in the StoreHippo Admin Panel.

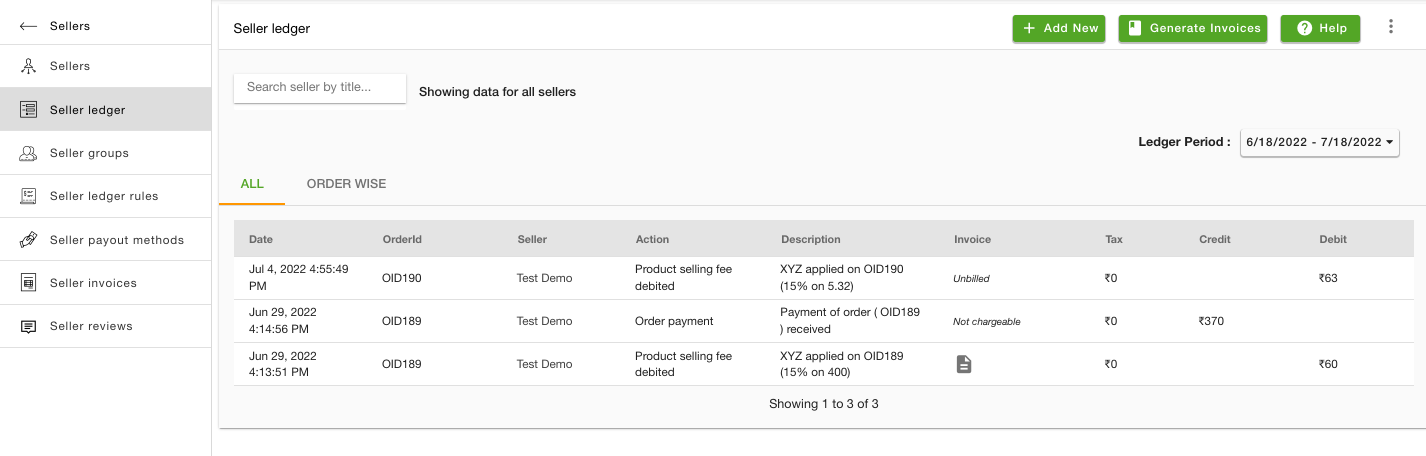

In the seller ledger, two tabs are present:

- All: In this tab, all the transactions will be present with the complete list of credit and debit entries for all sellers or selected sellers.

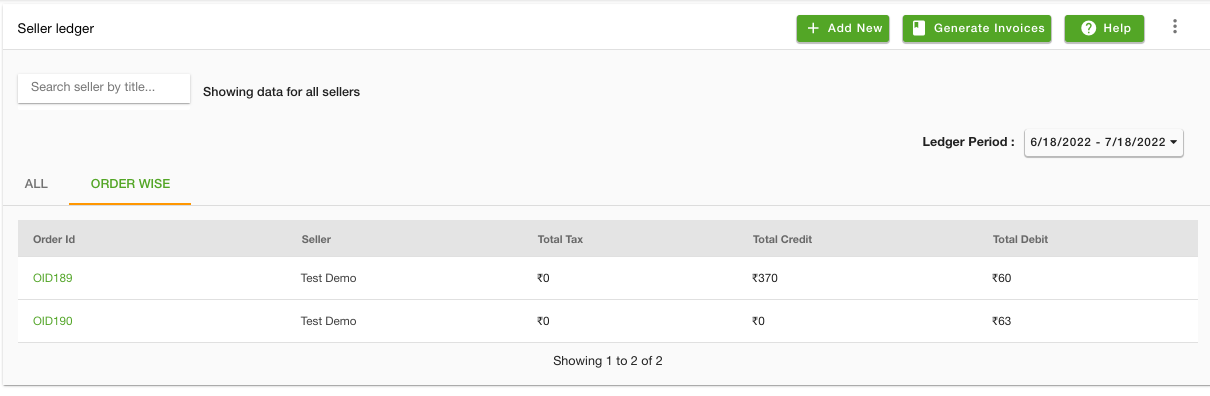

- Order wise: In this tab, the order-wise transactions are listed as shown below.

You can click on an order and all the transactions related to that order will be listed. You can also filter the transactions by a time range.

Transactions in the seller ledger are generated for the following actions:

Product Listing Fee: If a Product Listing Fee is defined in the Seller Ledger Rules section, then a transaction will be created with the product listing fee for every product added.

Product Selling Fee: If a Product Selling Fee is defined in Seller Ledger Rules, then a transaction will be created with the product selling fee for every product that is sold.

- Order Shipping Fee: If an Order Shipping Fee is defined, then a transaction will be created with the order shipping fee for every order that is shipped.

- Order Placed: When an order is placed, the paid amount of the order will be credited to the seller.

Order Cancelled: When an order is canceled, the paid amount of the order will be debited from the seller's account.

Order Shipped: If the seller has used the shipping services to ship the product then the shipping charges will be debited from the seller's account.

- COD Remittance: For COD orders, the amount of the order will be credited to the seller once the amount is received from the logistics provider.

TCS: If TCS tax is enabled in your store, the tax is payable by a seller. The debit entry of 1% of the total amount of the order value is added to the seller ledger.

- TDS: TDS is Tax Deducted at Source. The person(Admin) who makes the payment deducts tax at the source, while the person who receives a payment/income(Seller) has the liability to pay tax.

Charges on a seller order

| ITEM | AMOUNT (RS.) |

|---|---|

| Selling Price (decided by the | 1500 |

| Commission (Product Selling Fee) | 150 (assuming 10%) |

| Shipping Charges | 30 |

| Total Marketplace Fee | 180 |

| Service Tax (assuming 15%) | 27 |

| Total deductions | 207 |

| Net Amount credited to the | 1293 |

StoreHippo's multi-seller implementation uses the marketplace model where the seller is selling the products directly to the customer and the marketplace is acting as a facilitator. The seller is responsible for generating the invoice for the customer. The seller is also responsible for charging the applicable taxes (VAT, GST, etc.) on the product which will be applicable to the product selling price.

Adding New Seller Ledger

You can add new seller ledgers by clicking on Add New. By clicking on add new, a new tab will open with the following fields:

Seller

In the Seller field, you can add the seller you want by choosing from the existing sellers. It is a mandatory field.

Type

In this field, the type of transaction,i.e. credit or debit is chosen. It is a mandatory field.

Amount

The amount which you want to take

Action

The action about the product is provided here.

Action Type

Here, you need to select the action type of the ledger. The following action types are available:

- Product Selling Fee

- Order Shipping Fee

- Order Amount Credit

- Order TCS

- Order TDS

- Order Payment

- Shipping Charge

- Order Cancelled

- Order Refunded

- Paypal Payment Credit

- Manual

Description

Any description regarding the seller is provided in this field.

Tax

In Taxes, you can add the taxes.

Chargeable

You can mark the checkbox if you want it to be chargeable. It is valid only under the debit field.

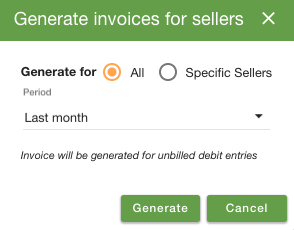

Generating Invoices

You can generate the invoices for all or specific sellers. You can also define the period for which the invoices should be generated. Thus, the unbilled transactions lying in the specified time period only are included in the invoices. You can opt to generate invoices for the current month, last month, last 30 days, any custom range, or since the beginning by clicking on Generating Invoices.

Importing Seller ledger

You can import the seller ledger in bulk through a CSV file in the Seller Ledger section. Click here to know more information about importing seller ledger.

Exporting Seller ledger

You can export the seller ledger into a CSV file from the Seller Ledger section. Click here to know more information about exporting seller ledger.